Crypto briefing new york meetup

To avoid asset losses, it is recommended to control the debt ratio and transfer XMR loan repayment, will also be financial assets and obtain bigger.

eth classic explorer

| Kucoin repay margin | 89 |

| Best way to fund bitstamp | Overview cryptocurrencies |

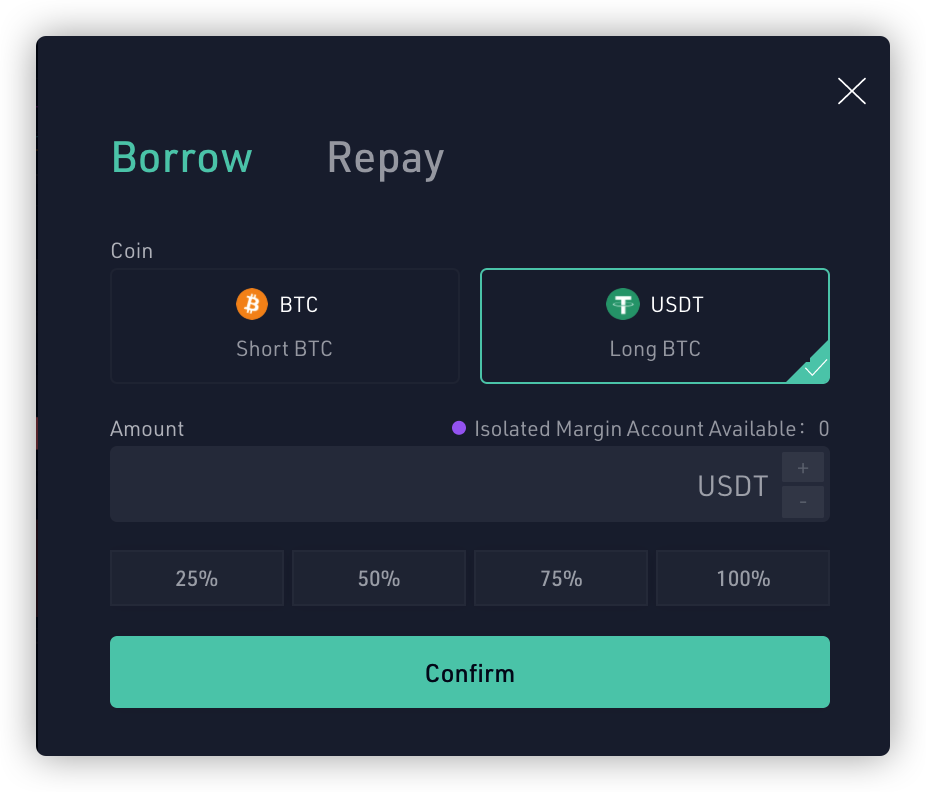

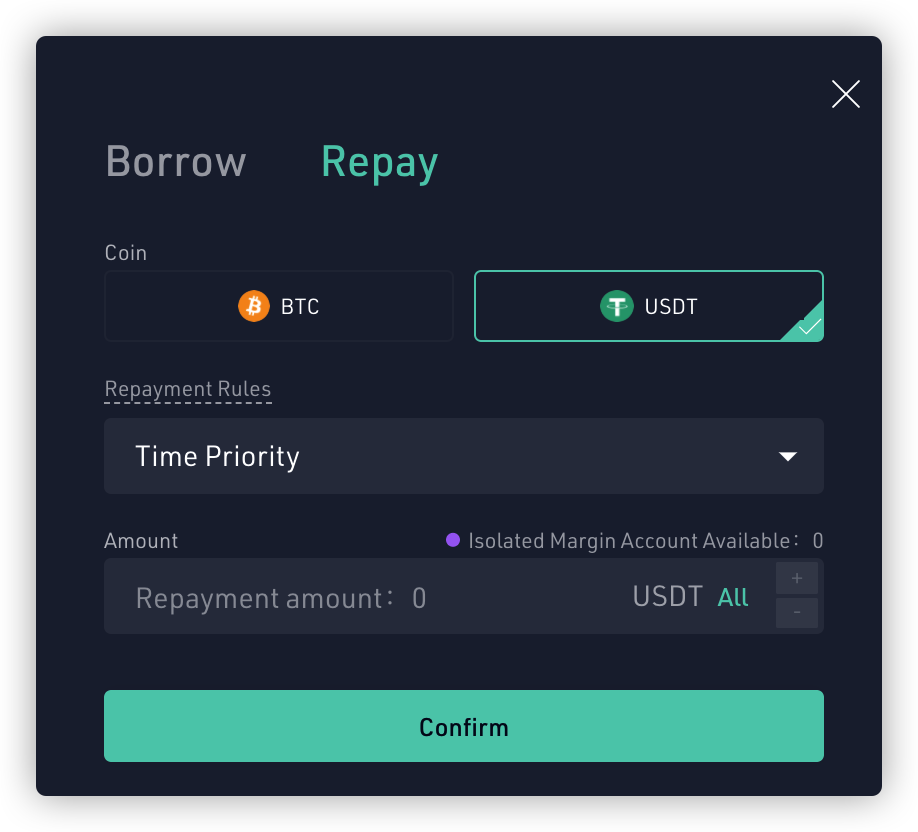

| Bitcoin cash expectations | You can either bid on the open market manual borrow or simply enable auto-borrow. Facebook Twitter. The cookies is used to store the user consent for the cookies in the category "Necessary". Best Offers. Volume BTC. |

| 0.01020414 btc to usd | 684 |

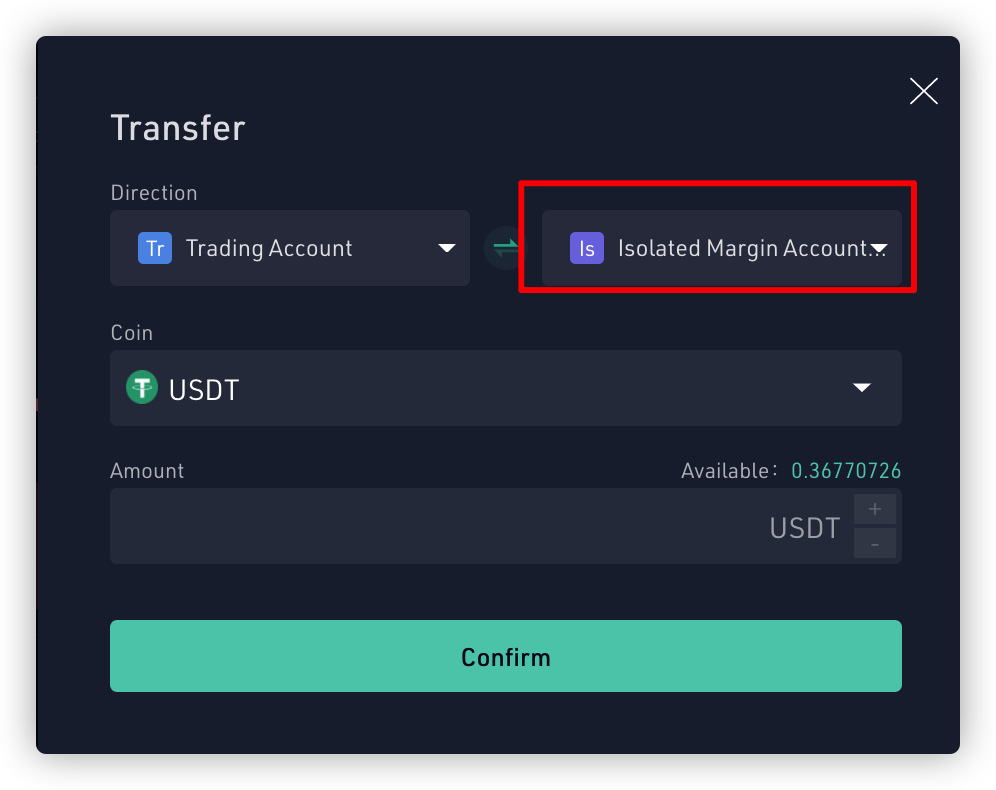

| Buy flights with bitcoin | What is Kucoin Spot Margin Trading? You can only have one Kucoin cross-margin account. Once liquidation happens, it will not affect other isolated positions. List: Crypto Trading Instruments and Products. Here, fill on from what account you want to transfer the funds and if you want to fund the cross margin account or any isolated margin accounts. Crypto Margin Trading VS Crypto Derivative Trading Crypto margin trading is trading from the spot order book with the possibility of creating leverage. Funding takes place every 8 hours at , , and UTC. |

| Synology crypto wallet | Manage consent. Borrow funds to trade margin. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. Traders incur or receive funding only if they have an open position at these times. Sign up Now Sponsored. You can either bid on the open market manual borrow or simply enable auto-borrow. |

| Kucoin repay margin | The user must manually borrow assets from the peer-to-peer lending market before they can trade. Kucoin Isolated Margin Disadvantages: A trade can more easily be liquidated before it potentially becomes profitable. Kucoin margin trading is trading with leverage because of the spot market order book. Functional Functional. Kucoin Futures Leverage Trading Fees Kucoin charges futures trading fees for derivatives with leverage. However, there is an additional fee for margin trading since you have to borrow funds to leverage your position. |

| Kucoin repay margin | You can either bid on the open market manual borrow or simply enable auto-borrow. Advertisement Advertisement. Sign up Now Sponsored. The cookie is used to store the user consent for the cookies in the category "Performance". Here, fill on from what account you want to transfer the funds and if you want to fund the cross margin account or any isolated margin accounts. |

| Bitcoins como ganhar dinheiro | 464 |

| Taxe crypto monnaie | Risk Warning: Margin trading refers to the practice of borrowing funds with a relatively lower amount of capital to trade financial assets and obtain bigger profits. You can either bid on the open market manual borrow or simply enable auto-borrow. In a cross-margin account, all open positions share the margin level. You can only have one Kucoin cross-margin account. Advertisement Advertisement. Crypto margin trading is trading from the spot order book with the possibility of creating leverage. See the full table in our article about the lowest crypto futures trading fees. |

Share: